Australia’s real estate market is rapidly evolving. As one of the most profitable industries, it is a reflection of the country’s economic health, demographic trends, and urban development patterns.

Major cities like Melbourne, Sydney, and Brisbane have high property values due to the high density of investments and economic activity in these places, while regional areas are generally more affordable yet offer an appealing alternative to a fast-paced urban lifestyle.

This article explores Australia’s real estate growth, particularly its increasing appeal to international investors and the current trajectory of the industry as a whole.

Overview of Australia’s Property Market

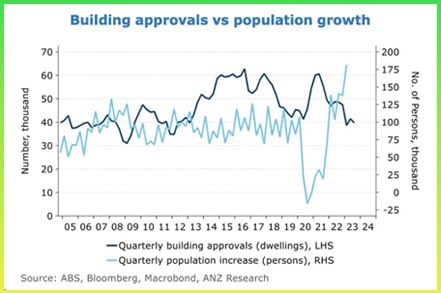

Australia currently has about 26.9 million people. By the end of the decade, the population is expected to reach 29 million, possibly up to 40 million by mid-century, driving up the demand for housing and infrastructure.

Current Market Trends

The property market is experiencing dynamic shifts.

For instance, the AU government pointed out Australia’s housing crisis, noting it has fewer homes per 1,000 people than the Organisation for Economic Cooperation and Development (OECD) average.

There’s also a notable shortage of housing in urban areas, leading to competition among buyers and driving up real estate prices.

Factors Driving Market Growth

Australia’s real estate market is driven by the following factors:

- Low Interest Rates – The Reserve Bank of Australia offers low-interest rates, encouraging more people to take out mortgages and invest in property.

- Foreign Investment – Foreign investors, especially from Asia, continue to drive demand for Australian properties despite regulatory constraints.

- Infrastructure Development – The Australian government is building transportation, healthcare, and education facilities to make certain areas more attractive to buyers.

The Appeal of Investing in Australian Real Estate

Australia’s real estate market is particularly attractive due to the country’s relatively stable economy, low interest rates, and steady population growth. Government incentives for first-time buyers also attract more domestic and international investors.

Economic Stability

As of 2023, Australia is the 13th largest national economy. Its robust economy boasts consistent gross domestic product (GDP) growth, low unemployment, and a well-regulated financial system.

The transparent and predictable legal framework for property transactions also boosts investor confidence and security and makes an already appealing real estate market even more attractive.

High ROI Property Returns on Investment

AU’s property market has historically increased in value over time, boosting consumer confidence and providing a decent return on investments (ROI).

Government incentives and good tax policies also make investing cheaper and more profitable. Moreover, the strong rental market offers investors good returns, especially in busy cities and popular regions.

Attractive Lifestyle and Environment

Excellent healthcare, world-class education, and recreational amenities make Australian cities one of the most desirable places in the world to live.

The country’s beautiful beaches, national parks, and nice weather makes it appealing to both local and international buyers looking for a better quality of life.

Key Cities for Real Estate Investment in Australia

The following cities feature significantly in Australia’s real estate market:

Sydney

Sydney is Australia’s biggest city, known for its vibrant culture, great living conditions, and strong local economy.

It offers diverse investment opportunities from luxury apartments to more affordable housing. Projects like the Sydney Metro and Barangaroo also present promising prospects for capital growth.

Sydney’s property market is set to grow due to ongoing infrastructure projects and more people moving in. However, market fluctuations and policy changes could affect property values and rental income.

Melbourne

As the second-largest city, Melbourne’s property market is very active, thanks to its reputation as a major cultural and economic center.

Investors can find good opportunities in central areas and suburbs being updated with new transport links or big redevelopment projects. Rental properties are also popular because more students and professionals are relocating to the area.

New transport links and commercial projects are expected to boost both property values and rental demand. Moving forward, Melbourne’s property is expected to grow due to its rising population and infrastructure investments.

Brisbane

Brisbane’s property market is relatively more affordable than Sydney and Melbourne. Like both major cities, it also boasts a growing population and a high standard of living.

Residential properties in developing suburbs have the potential to increase in value. Meanwhile, infrastructure projects like the Brisbane Metro attract investors and areas with high rental demand, especially near universities and major hubs, continue to draw in significant interest.

Brisbane’s growing population and affordability make it a good choice for long-term investors, though it’s important to consider potential market and economic changes before making a purchase.

Property Management Essentials

Aside from agents, property managers are indispensable in the real estate industry. They ensure efficient tenant management, including lease negotiations, screening, and handling disputes.

Choosing the Right Property Management Company

Here are some key factors to consider when choosing a property management company:

- Experience and Reputation – Choose a company with a strong track record. Experienced firms manage different types of properties and have reliable contractors and service providers on their roster.

- Offered Services – An ideal company offers complete services like lease management, tenant screening, rent collection, maintenance, and legal compliance, making property management easier.

- Fees and Contracts – A good property management company has clear fee and contract terms for management, leasing, and extra charges, so there are no unexpected costs.

Many Australian real estate companies tap property managers to make their processes more efficient. Professionals also help increase rental income and property value with effective strategies and maintenance.

In addition, professionals manage daily operations and can greatly reduce the stress and learning curve that comes with tenant management, maintenance, and even legal issues.

Property Maintenance and Upkeep

Real estate properties need regular maintenance to maintain their value and keep tenants satisfied. Some of the most essential maintenance practices include:

- Routine Inspections – Regular inspections of plumbing, electrical systems, and the building structure help detect and nip problems in the bud before they escalate into major issues.

- Preventive Maintenance – Preventive measures like cleaning gutters and servicing heating, ventilation, and air conditioning (HVAC) systems help avoid costly repairs and slow down the property’s overall depreciation.

- Timely Repairs – Addressing repairs quickly, such as fixing leaks or electrical issues, keeps the property in good condition and encourages tenants to stay on longer.

It’s important to allocate regular funds for maintenance and keep detailed records to track spending and find ways to save.

More importantly, choose reliable contractors and get multiple quotes to take advantage of competitive pricing.

Tenant Management

Property managers are responsible for finding and retaining quality tenants. Here’s how they typically go about it:

- Thorough Screening – This involves a detailed screening process with background checks, credit history, and rental history.

- Interview Process – Property managers interview potential tenants to check their suitability and to answer any questions about the property and lease terms.

- Lease Renewals – Aside from finding tenants, they offer lease renewal incentives, like small upgrades or accommodating changes to lease terms, to encourage good tenants to extend their contracts and stay on.

To sum it up, property management companies handle lease agreements, covering rent, maintenance duties, and legal rights, making sure they are clear, complete, and compliant.

Market Growth and Returns

Australia’s real estate industry employs over 142,000 individuals and has an impressive revenue of $86.15 billion AUD. As of the moment, it has a compound annual growth rate of 1.9% from 2019 to 2024.

Historical Performance of the Australian Real Estate Market

For the past few decades, property prices in major Australian cities like Sydney and Melbourne have steadily increased. Regional areas, including Brisbane and Perth, have also seen significant growth during different economic periods.

Year-over-Year Growth Rates

The AU market saw an average annual growth rate of approximately 20% in major cities. In 2021, for instance, property prices surged across many cities due to low-interest rates and increased demand.

However, as shown by the figure above, the population is growing faster than building approvals, suggesting a need for more infrastructure projects.

Comparative Analysis with Other Markets

Australia’s property market is recognised for its stability and resilience. Despite economic fluctuations, the AU housing market has maintained consistent growth compared to other global markets.

In the Asia-Pacific region, the AU market stands out for its accessibility and better long-term growth prospects for potential investors. It also has strong economic ties with Asia, particularly China, enhancing trade and investment opportunities.

Future Growth Projections

Analysts predict that properties in Sydney, Melbourne, and Brisbane will keep increasing in value, but at a slower rate due to the following factors:

Expert Predictions

The rental market should remain strong as demand grows in both cities and regional areas, driven by population increases and more people opting to rent instead of buy.

Experts also expect ongoing government incentives for first-time homebuyers to support the market. However, changes in policies like zoning and taxation could affect future growth.

Economic and Demographic Factors

Australia’s growing population will undoubtedly boost demand for housing. The aging population may also increase the need for retirement living and aged care facilities.

On the other hand, cities will grow quickly as more people move to metropolitan areas for better jobs and lifestyle opportunities.

International Investment in Australian Real Estate

Foreign property investors that favour Australia often swear by the following:

- Favourable Investment Laws – The country has a strong legal framework, particularly when it comes to property rights.

- Stable Currency – In addition, the Australian dollar is more stable compared to other currencies, reducing currency risk for investors.

- Political and Economic Stability – The government also offers incentives for foreign investments, like favourable tax treatments and streamlined processes.

How to Capitalise on the Real Estate Boom

A booming real estate industry creates a ripple effect throughout the economy. As such, the benefits extend beyond real estate and also cover:

- Construction and Renovation – Older properties would require upgrades and renovations, creating opportunities for contractors, designers, and remodelers.

- Financial Services – Mortgage lenders and insurance providers could experience higher demand for home loans, mortgage products, and property insurance.

- Home Improvement Retailers – Increased construction and renovation drive sales for lumber, appliances, fixtures, and home decors.

- Technology and Smart Home Solutions – A lot of homeowners would also seek modern solutions in home automation, security, and energy efficiency.

- Legal Services – Real estate attorneys are highly required for property transactions, disputes, and compliance with regulations.

- Tax and Investment Consulting Services – Professionals help homeowners navigate real estate investments and save on taxes.

Navigating Legal and Financial Stability

Foreign investors need approval from the Foreign Investment Review Board (FIRB) to ensure their investment meets national guidelines.

Also, they hire a solicitor or conveyancer to manage legal paperwork, review contracts, and keep the transactions in line with Australian property laws.

Securing financing from Australian banks and financial institutions is also crucial. This requires a strong credit assessment, so it’s helpful to work with financial advisors.

Frequently Asked Questions

Here are some of the most frequently asked questions about the AU real estate industry:

Question #1: What Types of Properties are the Most Popular Among Investors in Australia?

Many investors focus on building residential, commercial, and development properties:

- Residential Properties – Apartments in major cities like Sydney and Melbourne are popular for their high rental demand and good potential for value growth. Suburban areas also attract investors looking for houses and lots with long-term value growth potential.

- Commercial Properties – Retail spaces and office buildings rely on stable, long-term leases, and strong business demand. Offices in key business areas and top shopping centers can be especially profitable.

Question #2: Are There Restrictions for Foreign Investors in the Australian Real Estate Market?

Yes, foreign investors usually need approval from the Foreign Investment Review Board before they can buy property.

The FIRB approval is typically required for buying residential properties, though there are some exceptions for new developments or properties built specifically for renting.

However, foreign investors are generally restricted from buying existing residential properties unless they plan to redevelop or use them for rental purposes.

Question #3: What are the Legal Requirements for International Investors?

Aside from the FIRB approval, foreign investors must follow local zoning and land use regulations, including any property use and development restrictions.

Lastly, they should hire a property management firm to handle tenant relations, maintenance, and rental regulations, especially if they’re investing in multiple properties.

Conclusion

Australia is an ideal place for tourists and investors alike. With its desirable living conditions, favourable investment laws, and economic resilience, the AU real estate industry attracts international investors to boost the economy.

With the help of outsourcing providers like Remote Staff for staffing needs, local and foreign investors can better manage and grow their real estate companies to maximise this opportunity.

Click here to know more.

Syrine is studying law while working as a content writer. When she’s not writing or studying, she engages in tutoring, events planning, and social media browsing. In 2021, she published her book, Stellar Thoughts.